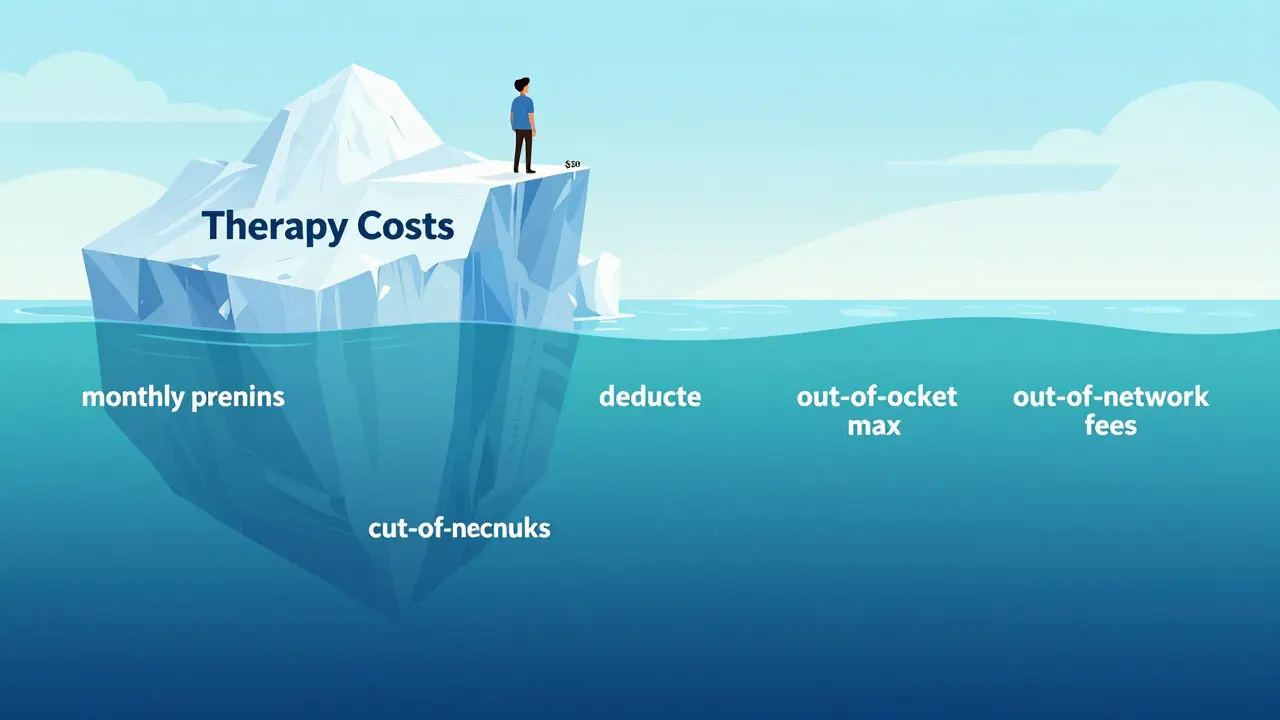

Therapy isn't just about the copay you see on your insurance card

Most people think they know what therapy costs because they see a $30 copay on their insurance card. But that number? It’s just the tip of the iceberg. If you’re planning to attend therapy regularly-weekly or even biweekly-you could be looking at thousands of dollars a year, not just a few hundred. And if you haven’t met your deductible yet? You might pay $125 or more per session before insurance kicks in. Many patients are shocked when they get their first bill and realize they owe $500 for a single session. That’s not a mistake. That’s how insurance works.

What’s really included in your therapy bill?

Your total therapy cost isn’t just the copay. It’s made up of several pieces: your monthly premium, your deductible, coinsurance, out-of-pocket maximums, and whether your therapist is in-network or out-of-network. Each one changes how much you pay, and ignoring even one can leave you with a huge surprise.

Let’s break it down:

- Monthly premium: This is what you pay every month just to have insurance, whether you use therapy or not. For 2024, the average individual premium in Australia and the U.S. ranges from $200 to $500 per month, depending on your plan.

- Deductible: This is the amount you pay out of pocket before your insurance starts sharing the cost. In 2024, individual deductibles can be as high as $9,350. Some plans have separate mental health deductibles, which means your physical therapy visits don’t count toward your therapy deductible.

- Copay: A fixed amount you pay per session after meeting your deductible. This is usually $20-$55, but it’s only relevant once you’ve hit your deductible.

- Coinsurance: Instead of a fixed copay, some plans make you pay a percentage-like 20% or 30%-of the allowed amount for each session. That means if your therapist charges $150 and your insurance allows $120, you pay 20% of $120, which is $24.

- Out-of-pocket maximum: This is the most you’ll pay in a year for covered services. After you hit this limit, your insurance covers 100% of therapy costs. For 2024, the cap is $9,350 for individuals and $18,700 for families.

Why your in-network vs. out-of-network therapist changes everything

Choosing a therapist who’s in-network can save you hundreds-or even thousands-of dollars. In-network providers have agreed to accept your insurance’s negotiated rate. Out-of-network therapists don’t have that deal, so they can charge whatever they want. Your insurance might still cover part of it, but you’ll pay more.

Here’s how it plays out:

- In-network: You pay your copay or coinsurance. Example: $40 per session after deductible.

- Out-of-network: You pay the full fee upfront, then submit a claim. Your insurance pays a percentage of their allowed amount (often 50-70% of what they’d pay in-network). You’re stuck with the rest. If the therapist charges $180 and your insurer allows $120, you pay $180, then get back $60-$84. That means you’re still paying $96-$120 out of pocket.

That’s nearly triple the cost. And if you’re seeing someone weekly for months? That adds up fast.

How to calculate your real therapy cost (step by step)

Let’s say you’re planning for 20 therapy sessions this year, and your therapist charges $125 per session. Your plan has a $1,500 deductible, $40 copay after deductible, and 20% coinsurance. Here’s how to figure out your total cost:

- Phase 1: Before deductible is met - You pay full price until you hit $1,500. At $125 per session, that’s 12 sessions ($125 × 12 = $1,500).

- Phase 2: After deductible is met - You now pay $40 per session. You have 8 sessions left. $40 × 8 = $320.

- Total out-of-pocket - $1,500 + $320 = $1,820.

Compare that to the full cost without insurance: $125 × 20 = $2,500. You saved $680 just by having insurance. But if you thought you’d only pay $40 × 20 = $800, you’d be off by over $1,000.

Now, imagine you’re on a coinsurance plan instead. Same $1,500 deductible. Same $125 session fee. But after deductible, you pay 20% of the allowed amount. Let’s say your insurer allows $120 per session. You pay 20% of $120 = $24 per session. Total cost: $1,500 (deductible) + ($24 × 8) = $1,692. Still more than you’d think.

What if you don’t have insurance?

If you’re uninsured or your plan doesn’t cover mental health, you’re not stuck. Many therapists offer sliding scale fees based on your income. According to Thriveworks’ 2024 data, about 42% of private practice therapists adjust their rates for people who can’t afford full price. That could mean paying $50-$70 per session instead of $125-$200.

Other options:

- Open Path Collective: A nonprofit network that connects people with therapists charging $40-$70 per session.

- University training clinics: Graduate students provide therapy under supervision at 50-70% off market rates.

- Community health centers: Often offer mental health services on a sliding scale.

These aren’t perfect substitutes for insurance, but they’re far better than paying full price or skipping care.

Medicare and Medicaid: How they change the math

If you’re on Medicare, therapy costs look very different. Medicare Part B covers 80% of the cost of outpatient mental health services. That means you pay 20% of the Medicare-approved amount. For a $143 session, you’d pay about $28.65. But if you don’t have a Medigap Plan G, you’re still on the hook for the 20% and any deductible. Plan G covers the 20% coinsurance, but it adds a monthly premium of $120-$200.

Medicaid, on the other hand, usually has little to no copay for therapy. If you qualify, your out-of-pocket cost might be $0-$5 per session. That’s the most affordable option for low-income patients.

Hidden costs no one talks about

Therapy isn’t just about the session fee. There are other expenses that pile up:

- Transportation: Gas, public transit, or rideshares to and from appointments. If you go weekly, that’s $50-$100 a month.

- Time off work: Missing an hour a week adds up. If you’re hourly, that’s lost wages.

- Prescription meds: If your therapist recommends medication, you’ll pay for that too. Antidepressants can cost $10-$50 a month with insurance, $200+ without.

- Missed deductible opportunities: Some people avoid getting a physical or lab work done because they think it’s not urgent. But every medical service you use counts toward your deductible. If you’ve got a $1,500 deductible, a $300 MRI or a $100 blood test could get you halfway there faster.

How to plan your budget before you start

Don’t wait until you’re deep into therapy to realize you can’t afford it. Here’s how to plan ahead:

- Call your insurance company. Ask: What’s my mental health deductible? Is it separate from medical? What’s my copay or coinsurance? What’s my out-of-pocket max?

- Ask your therapist. What’s your fee? Are you in-network? Do you offer sliding scale?

- Estimate your session count. Most people see improvement after 12-16 sessions. For complex issues like PTSD or long-term depression, 15-20 sessions is common.

- Build a three-phase budget:

- Phase 1: Full cost until deductible is met

- Phase 2: Copay or coinsurance after deductible

- Phase 3: What happens if you hit your out-of-pocket max?

- Use tools. Alma’s Cost Estimator Tool, Rula’s calculator, or even a simple spreadsheet can help you map it out.

What most people get wrong

Here’s the biggest mistake: assuming your copay is your total cost. It’s not. It’s the cost after you’ve already paid hundreds or thousands. People think, “I have a $30 copay, so therapy is cheap.” Then they hit their deductible and suddenly owe $125 per session for months. That’s when they drop out.

Another mistake: waiting until they’re in crisis to start. Therapy is an investment. The sooner you start, the fewer sessions you’ll need. Waiting until you’re overwhelmed means more sessions, higher costs, and more stress.

And don’t forget: your deductible resets every year. If you start therapy in November, you might pay $1,500 in just two months. But if you start in January, you spread that cost over the whole year.

Final tip: Talk to your therapist about money

Therapists aren’t salespeople. They’re healthcare providers. And most of them understand how expensive therapy can be. Don’t be embarrassed to say: “I’m on a tight budget. Can we talk about options?” Many will adjust sessions, offer payment plans, or refer you to low-cost resources. You’d be surprised how often they’ve helped someone in your situation before.

Is my copay the only thing I pay for therapy?

No. Your copay is just the amount you pay after you’ve met your deductible. Before that, you pay the full session fee. You also pay monthly premiums, and if your plan uses coinsurance, you pay a percentage of each session even after meeting your deductible. Transportation, time off work, and medication can add more.

What’s the difference between in-network and out-of-network therapists?

In-network therapists have agreed to a discounted rate with your insurance. You pay your copay or coinsurance, and the insurance covers the rest. Out-of-network therapists don’t have that deal. You pay the full fee upfront, then submit a claim. Your insurance pays a percentage of their allowed amount-often much less than what the therapist charges-so you end up paying more out of pocket.

How do I know if I’ve met my deductible?

Log into your insurance portal or call customer service. They’ll show your current deductible balance. You can also check your Explanation of Benefits (EOB) statements after each visit-they list how much was applied to your deductible. Many people don’t realize their deductible includes every medical service, not just therapy.

Can I use my HSA or FSA for therapy?

Yes. Both Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can be used to pay for therapy, copays, and related costs like transportation if you have a letter from your provider. This is a great way to use pre-tax dollars to lower your out-of-pocket cost.

What if I can’t afford therapy even with insurance?

Many therapists offer sliding scale fees based on income. You can also check Open Path Collective, university training clinics, or community health centers. These options often charge $40-$70 per session. Some online platforms like BetterHelp offer financial aid. Don’t assume therapy is out of reach-ask about options before giving up.

Does Medicare cover therapy?

Yes. Medicare Part B covers 80% of the cost of outpatient mental health services. You pay the remaining 20%. If you have a Medigap Plan G, it covers that 20% coinsurance. Without it, you’ll pay the full 20% plus your Part B deductible. For a $143 session, you’d pay about $28.65.

evelyn wellding on 17 January 2026, AT 03:27 AM

OMG YES THIS!! I thought my $35 copay meant therapy was affordable... then I got billed $180 for a session and cried in the parking lot 😭 Thank you for breaking this down so clearly!