By 2025, Medicare Part D has changed in ways that make prescription drugs far more predictable - and affordable - for millions of seniors. If you're on Medicare and take any medications, understanding how Part D works now isn’t just helpful. It’s essential.

What Medicare Part D Actually Covers

Medicare Part D is the part of Medicare that helps pay for prescription drugs. It’s not automatic. You have to sign up for it separately, either through a stand-alone Prescription Drug Plan (PDP) or as part of a Medicare Advantage plan that includes drug coverage (MA-PD). Either way, private insurance companies run these plans under rules set by Medicare.

It covers both brand-name and generic drugs, but not every drug. Each plan has its own list - called a formulary - that says exactly which drugs are covered and at what cost. If your medication isn’t on the list, you might pay full price. That’s why checking your plan’s formulary every year matters.

The New 2025 Coverage Structure: No More Donut Hole

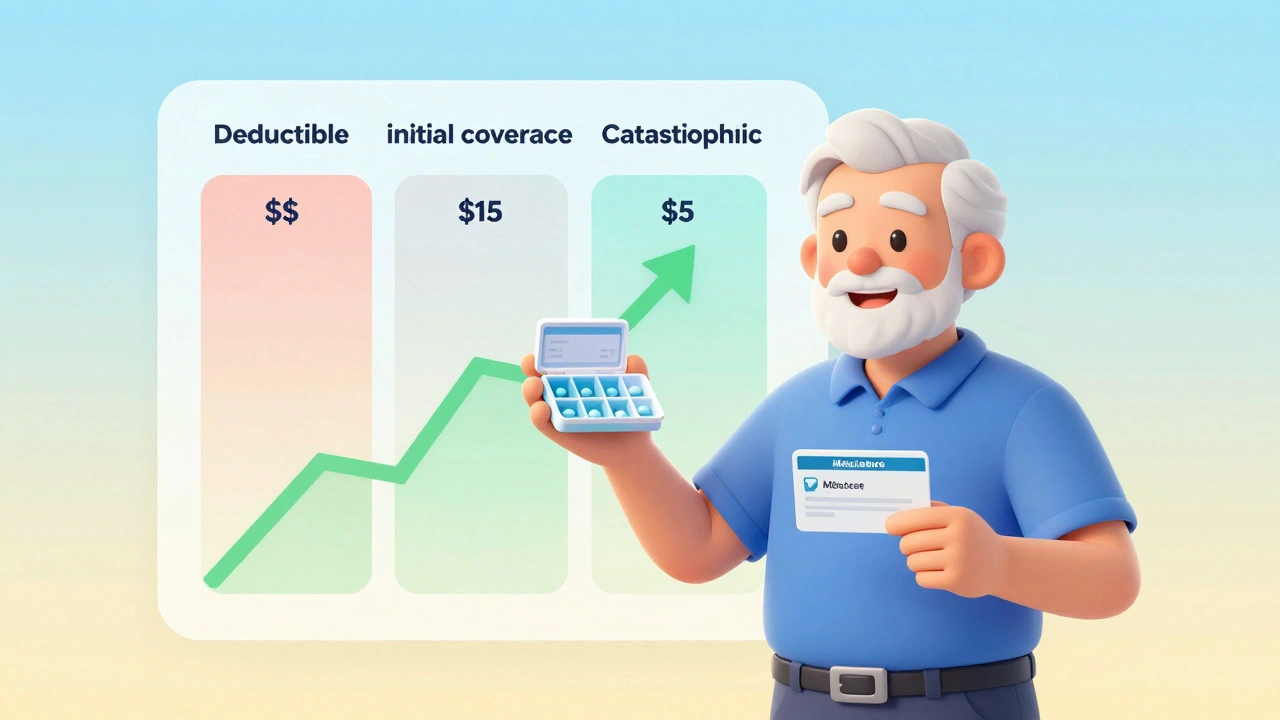

Before 2025, Part D had four phases: deductible, initial coverage, coverage gap (the "donut hole"), and catastrophic coverage. The donut hole was confusing. You’d hit a point where you paid a lot more out of pocket, even if you were still spending money on drugs. That’s gone.

Now, there are just three phases:

- Deductible phase: You pay 100% of drug costs until you hit the deductible. In 2025, the maximum deductible is $590. Some plans have lower deductibles - even $0.

- Initial coverage phase: After you meet the deductible, you pay 25% of the drug cost. The plan pays 65%, and drug manufacturers give a 10% discount on brand-name drugs. This continues until your total out-of-pocket spending (including what you paid during the deductible) hits $2,000.

- Catastrophic coverage phase: Once you hit $2,000 in out-of-pocket costs, you pay nothing for the rest of the year. No more coinsurance. No more surprises. The plan pays 60%, manufacturers pay 20%, and Medicare pays 20%.

This $2,000 cap is the biggest change since Part D started. Before, you could pay up to $8,000 out of pocket before hitting catastrophic coverage. Now, even if you take expensive drugs, your annual drug spending is capped at $2,000 - not counting your monthly premium.

What You Still Pay: Premiums, Copays, and Tiers

Even with the $2,000 cap, you’re not done paying. You still pay a monthly premium for your Part D plan. In 2025, the average premium for a stand-alone drug plan is $45. For Medicare Advantage plans with drug coverage, it’s just $7. That’s a big difference.

Plans also use drug tiers to control costs. Most have five tiers:

- Tier 1: Preferred generics - lowest cost, often $5 or less per prescription.

- Tier 2: Generics - slightly higher than preferred generics.

- Tier 3: Preferred brand-name drugs - higher cost, but still covered well.

- Tier 4: Non-preferred brand-name drugs - you pay more, sometimes 30-40%.

- Tier 5: Specialty drugs - very high-cost medications like those for cancer or MS. You might pay 25% or more.

Always check which tier your drugs fall into. A drug you’ve used for years might move to a higher tier - and your cost could jump overnight.

Insulin and Other Special Rules

Insulin costs are capped at $35 per prescription, no matter which plan you’re on. That rule stays in place for 2025. Same for certain vaccines like shingles and flu shots - they’re free under Part D.

Some drugs are exempt from the deductible. That means you start paying your 25% coinsurance right away, even before hitting the $590 deductible. Check your plan’s details to see if your medications are on that list.

How to Pick the Right Plan for You

There are 48 Part D plans available on average to each Medicare beneficiary in 2025. That sounds like a lot - and it is. But here’s the trick: you don’t need the cheapest premium. You need the plan that costs the least for your drugs.

Use the Medicare Plan Finder tool on Medicare.gov. It’s free. Enter your medications, dosages, and pharmacy. It will show you total estimated costs for each plan - including premiums, deductibles, and what you’ll pay at the pharmacy.

Don’t assume your current plan is still the best. Plans change their formularies every year. A drug you need might be removed. A copay might go up. You might be moved to a different pharmacy network.

When to Enroll - And What Happens If You Don’t

You have a 7-month window around your 65th birthday to sign up for Part D without penalty. If you wait longer and don’t have other creditable drug coverage (like from an employer), you’ll pay a late enrollment penalty.

The penalty is 1% of the national base premium - $35.37 in 2024 - for every month you delay. That adds up. If you wait a year, you’ll pay an extra $4.24 per month, forever. Even if you don’t take drugs now, a low-premium plan can protect you later.

The annual enrollment period runs from October 15 to December 7. Changes take effect January 1. That’s your chance to switch plans if your meds changed or your costs went up.

Who Can Get Extra Help

If your income is low, you might qualify for Extra Help - a federal program that cuts your Part D costs even more. In 2025, 90 stand-alone Part D plans are available with $0 premium to Extra Help enrollees.

Extra Help covers premiums, deductibles, and copays. You don’t have to pay the $2,000 out-of-pocket cap because the program already does that for you. Apply at Social Security or through your state’s SHIP program.

Common Mistakes People Make

Most people get Part D wrong in one of these ways:

- Thinking the $2,000 cap includes premiums. It doesn’t. Premiums are separate. You might pay $500 in premiums and $2,000 in drug costs - that’s $2,500 total.

- Skipping the annual review. Plans change. Your meds might not be covered next year.

- Choosing a plan based only on the lowest premium. A $0 premium plan might charge $100 for your blood pressure pill. That’s worse than a $40 premium plan with low copays.

- Not checking your pharmacy network. Your local pharmacy might not be in-network. You’ll pay more - or nothing at all.

Where to Get Help

You don’t have to figure this out alone.

- Call 1-800-MEDICARE - they handled 78 million calls in 2023.

- Find your local State Health Insurance Assistance Program (SHIP). They offer free, one-on-one counseling. In 2023, they helped over 5 million people.

- Visit Medicare.gov and use the Plan Finder tool. It’s updated daily.

Don’t wait until you’re stuck with a $500 insulin bill. Review your plan now. Even if you’re happy with your current coverage, check if anything changed. The $2,000 cap is real. But only if you’re in the right plan.

Does Medicare Part D cover all prescription drugs?

No. Each Part D plan has its own formulary - a list of covered drugs. While all plans must cover at least two drugs in each drug class, they can choose which specific drugs to include. Some drugs, like weight-loss pills or fertility treatments, are never covered. Always check your plan’s formulary before enrolling.

Is the $2,000 out-of-pocket cap per year or per drug?

It’s per year, and it’s the total amount you pay for all covered Part D drugs combined. This includes your deductible payments, copays, and coinsurance. Once you hit $2,000 in 2025, you pay nothing for the rest of the year. This cap does not include your monthly premium.

Can I switch Part D plans anytime?

Generally, no. You can only switch during the Annual Enrollment Period (October 15 to December 7) or during a Special Enrollment Period - like if you move out of your plan’s service area, lose other drug coverage, or qualify for Extra Help. Outside those times, you’re locked in.

What happens if my drug is removed from the formulary?

Your plan must notify you at least 60 days before removing a drug you’re taking. You can request a temporary exception to keep the drug for up to 60 days while you and your doctor apply for a permanent exception. If denied, you can appeal or switch plans during a Special Enrollment Period.

Do I need Part D if I don’t take any medications?

Even if you don’t take drugs now, it’s smart to enroll in a low-premium plan. If you wait and later need coverage, you’ll pay a late enrollment penalty for as long as you have Part D. That penalty adds up - often $4 to $10 extra per month. A $10 plan now can save you hundreds later.

What’s Coming Next

In 2026, the out-of-pocket cap will rise to $2,100, and it will be adjusted for inflation every year after that. That’s good - it keeps pace with rising drug prices. But experts warn that new high-cost drugs, especially for rare diseases, could still strain the system.

The $35 insulin cap and the $2,000 out-of-pocket limit are the most meaningful changes in decades. They’ve turned a confusing, unpredictable system into one that finally protects people from financial ruin.

The real challenge now isn’t the rules - it’s knowing which plan matches your needs. Take 20 minutes this month to use the Medicare Plan Finder. Your wallet will thank you next year.

matthew dendle on 11 December 2025, AT 05:01 AM

so the gov finally figured out ppl cant afford to die from high blood pressure meds wow what a shocker lol